BEIJING/SHENZHEN: First, Vietnam and Indonesia. Now, the Philippines and Japan.

As the United States strikes a wave of trade deals across Asia, offering lower tariffs to key partners, analysts say Beijing may be pushed to respond, whether by deepening engagement with non-Western partners or showing greater flexibility in talks with traditional ones.

This includes the European Union (EU), which is set to hold a high-level summit with China in Beijing on Thursday (Jul 24). While some Chinese businesses in Europe are hoping for meaningful outcomes, observers caution that longstanding sticking points, such as industrial overcapacity and unequal market access, could limit progress.

“There may be some low-lying branches that the EU and China may reach for. Those would be a bonus for the bilateral relationship,” Lim Tai Wei, an East Asian affairs observer and professor at Soka University's business faculty, told CNA.

Still, analysts say China is under growing pressure from Washington’s economic manoeuvres in Asia.

“Pressure on the PRC (People’s Republic of China) will come in the form of exports from other economies being more competitive,” Chong Ja Ian, associate professor of political science at the National University of Singapore (NUS), told CNA.

Observers say Beijing is likely to be especially wary of clauses in the US trade deals that could directly or indirectly undermine its export interests. One example is the US-Vietnam agreement, which imposes far steeper tariffs on goods identified as being transshipped.

The Trump administration’s transshipment clause is aimed at Chinese firms that use countries in Southeast Asia as conduits for their products to avoid higher US tariffs.

ART OF THE DEAL

The US under President Donald Trump has been securing bilateral trade agreements across Asia, part of its wider “reciprocal tariff” strategy that rewards compliance with lower duties while penalising countries that do not play ball.

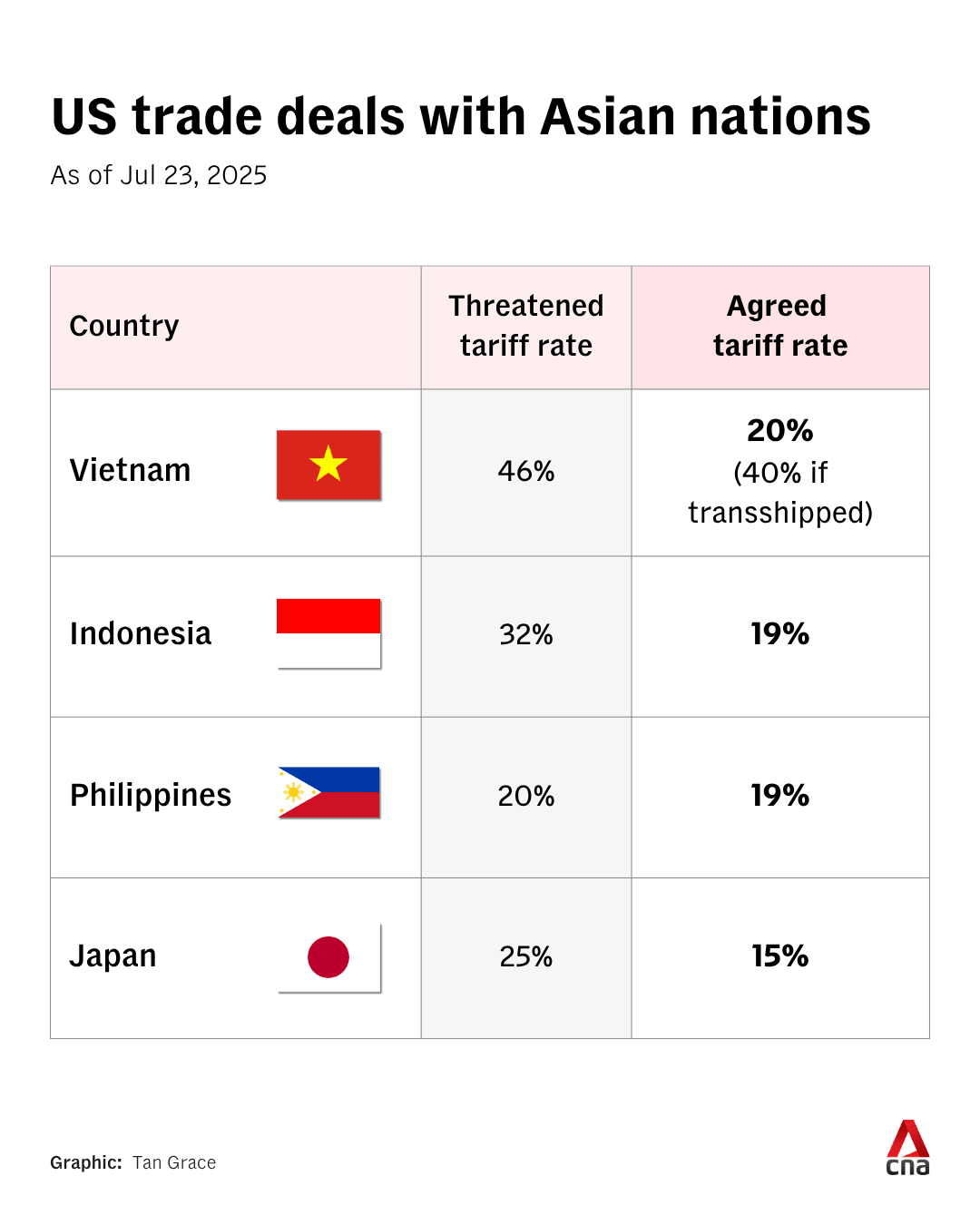

As of Wednesday, Japan, the Philippines, Vietnam, and Indonesia have all reached deals that reduce the tariff threats they initially faced, while deepening trade and investment ties with the US.

Trump announced the latest deals with Tokyo and Manila on Tuesday, just over a week ahead of his Aug 1 deadline. Japan will face 15 per cent duties, down from 25 per cent, alongside a sweeping investment commitment into the US worth more than US$550 billion.

In a post on his Truth Social media platform, Trump hailed the deal with Japan as “massive”, claiming the US would receive “90 per cent of the profits”.

"This deal will create hundreds of thousands of jobs - There has never been anything like it," he wrote.

Meanwhile, the Philippines secured a 19 per cent tariff rate, a touch below the 20 per cent levy floated earlier this month. The announcement followed a meeting between Trump and Philippine President Ferdinand Marcos Jr at the Oval Office.

Analysts say the US trade deals across Asia underscore how countries in the region continue to view the US as an integral economic partner.

“The eagerness for deals with the Trump administration suggests that most economies see the United States as indispensable, at least for now,” said NUS’ Chong.

At the same time, American dealmaking across Asia is turning up the heat on China by giving its regional export rivals a potential edge in accessing the world’s largest consumer market, say observers.

China is the largest trading partner for Indonesia and Vietnam.

Bilateral trade between China and Indonesia reached US$147.8 billion in 2024, a 6.1 per cent year-on-year increase, while China-Vietnam trade surged 14.6 per cent year-on-year to 1.85 trillion yuan (US$257.8 billion) that same year, according to China’s customs data.

China has also long been Japan’s largest trading partner, and one of the largest investment destinations for Japanese companies. Meanwhile, trade with the Philippines remains robust, although rising tensions in the South China Sea have cast a shadow over broader relations.

Experts say China will be scrutinising the fine print of the US trade deals across Asia, wary of any provisions that could directly or indirectly undermine its economic interests.

Particular attention is likely to focus on clauses targeting transshipments, the practice of rerouting Chinese goods through third countries to bypass tariffs.

For example, in the case of the US-Vietnam agreement, goods identified as transshipped face a 40 per cent tariff, double the 20 per cent baseline rate, signalling Washington’s intent to clamp down on workaround routes that have long benefited Chinese exporters.

Such provisions threaten to shut off a critical pressure valve in China’s trade strategy, raising costs for exporters and potentially diverting orders to rival manufacturing hubs that now enjoy more favourable terms.

This would also pile further economic stress on the Chinese economy, which is already contending with sluggish domestic demand, weak private investment and mounting demographic headwinds, including an ageing population and a shrinking workforce.

“Chinese pressure and displeasure can be expected if actual implementation of the deals damages Chinese economic interests such as reducing demand for their exports,” Hoo Tiang Boon, an associate professor at Nanyang Technological University’s (NTU) school of social sciences, told CNA.

China has consistently voiced strong opposition to any deal between the US and its trading partners that come at the expense of Chinese interests.

“If proven to damage Chinese interests … China may impose targeted sanctions such as curtailing exports which those countries need; or impose additional tariffs commensurate with those imposed by the Americans on Chinese goods,” he said.

Beijing and Washington are now nearing the end of an uneasy 90-day trade truce agreed in May, which put a pause on escalating tit-for-tat tariffs.

With the Aug 12 deadline looming, officials from both sides are set to meet in Stockholm next week to discuss a possible extension and narrow the gaps toward a broader trade agreement.

Given its sputtering economy, it would be unwise for Chinese policymakers to adopt an aggressive diplomatic stance against the US, said Benjamin Ho, assistant professor at the S Rajaratnam School of International Studies’ (RSIS) China Programme.

“It would attempt to buy time in order to diversify its economic exports. But the West still remains very much the main consumer market,” he said.

AS US DEALS, CHINA REVIEWS ITS HAND

Indeed, as Washington deepens its economic dealmaking across Asia, analysts say China will likely keep up its diversification strategy - strengthening ties with partners such as the EU, BRICS and ASEAN, in a bid to balance the scales.

“The current deals with the United States could encourage the PRC to work more with others, including the European Union,” said NUS’ Chong.

While Beijing will increasingly seek new partners for technological collaboration, potentially creating new business opportunities, Chong also warned of potential ripple effects.

“The diversion of PRC exports away from the United States could further flood other markets with cheap PRC goods, creating pressures on their enterprises,” he said, adding that thorny issues like overcapacity and intellectual property protection also remain.

CNA previously reported on how China’s export engines are increasingly aimed at Southeast Asia as Chinese products lose their lustre in the West, and how this would bring more benefits for consumers but also challenges for businesses in the region.

Against this backdrop, the upcoming EU-China summit on Thursday is set to be closely watched for signs of whether Beijing is prepared to offer trade concessions or recalibrate its approach to longstanding issues.

European Council President Antonio Costa and European Commission President Ursula von der Leyen will be attending the summit in Beijing, and are set to meet with Chinese President Xi Jinping and Chinese Premier Li Qiang.

Analysts have signalled low expectations for any breakthrough as trade frictions persist, and Europe remains wary of Beijing’s support for Russia’s war in Ukraine, as well as its broader challenges to international law and global institutions.

While the expectation of any immediate deal is low, China may be more flexible in addressing a wider range of issues and positioning itself as a “free trade enabler”, Gary Ng, senior economist at Natixis and research fellow at the Central European Institute of Asian Studies, told CNA.

“It can be the removal of certain sanctions or commitment to market access, or easing some anti-dumping duties,” he said.

European Commission spokesperson Olaf Gill has said that the upcoming summit provides an opportunity to address these concerns.

“That relationship … must be based on fair competition and on a level playing field,” he said at a regular press briefing on Jul 10.

“There are a number of trade-distorting measures, unfair competition and an unlevel playing field - challenges that the EU wants China to meaningfully address.”

Chinese businesses have urged EU and Chinese leaders to come together and reach a deal to reduce trade barriers.

“We the business community hold high expectations, hoping that China and Europe can seize this historic opportunity to achieve substantive results (at the summit)”, said Fang Dongkui, secretary general of the China Chamber of Commerce to the EU.

The chamber hopes the two sides can broker a deal to remove trade barriers in several areas, including the EU’s tariffs targeting Chinese electric vehicles, Fang told the South China Morning Post.

Soka University’s Lim said there is a possibility both sides could come to an agreement on “low-lying branches” such as brandy and on other secondary issues that could help ease pressure in the broader bilateral relationship.

In the lead-up to the summit, Chinese Foreign Minister Wang Yi met Estonian Prime Minister Kaja Kallas in Brussels on Jul 3. In a statement released by China’s Foreign Ministry, Wang said China does not see the EU as an adversary and called for managing differences through dialogue.

“China and the European Union should not be regarded as opponents because of differences, nor should they seek confrontation because of disagreements,” he said.

A day later, China excluded major cognac producers Pernod Ricard, LVMH and Remy Cointreau from planned anti-dumping duties on European brandy. The move stood out as a rare positive signal amid persistent trade tensions with Brussels, as both sides continue to clash over EU tariffs on Chinese-made electric vehicles, with Beijing signalling possible retaliation.

While gestures such as those on European brandy offer a potential path forward, NUS’ Chong said they remain largely symbolic without concrete follow-up.

“The manufacture and sales of these luxury items do not replace the effect from automobiles, for example,” he said.