The president, when talking about fuel in the new tax reform, said:"We tax gasoline, yes. But the poor hardly use gasoline; the ones who use the most gasoline are the ones with four doors."

It didn't take long for various Colombian political figures to reject the brief statement on the issue. Among them were María Fernanda Cabal, Daniel Briceño, and Jennifer Pedraza.

One of the first to react was María Fernanda Cabal, senator of the Democratic Center, who questioned the studies of the head of state.

“Whoever says this ‘graduated’ in economics. Petro claims that ‘the poor don’t use gasoline.’ And the diesel and gasoline used in trucks and vans that transport food? Of course they impact the pockets of all Colombians,” he wrote on his X account.

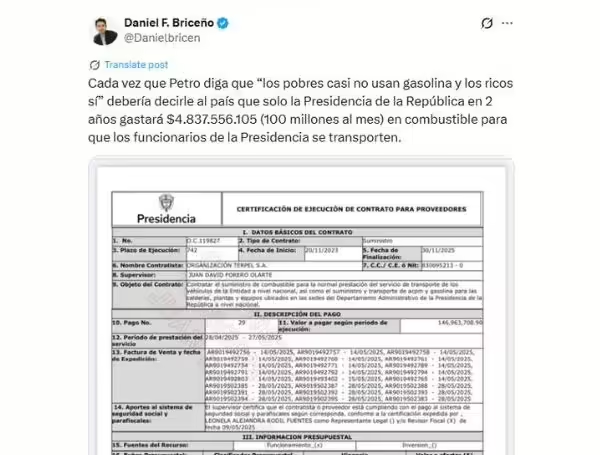

He was joined by Daniel Briceño, who left a document detailing the fuel expenditure during the presidency.

"Every time Petro says that 'the poor hardly use gasoline but the rich do,' he should tell the country that the Presidency of the Republic alone will spend $4,837,556,105 (100 million a month) on fuel for presidential officials' transportation in two years."

Councilman Óscar Apolinar pointed out that the president's words ignore the reality of millions of Colombians.

The politician wrote on his X account:"President, in Colombia there are more than 12 million motorcycles and 91% are in the hands of strata 1, 2 and 3. These are families that depend on them to work, study and bring food to their homes. To deny this is to ignore the reality of millions of Colombians." (sic)

On the other hand, Congresswoman Jennifer Pedraza also said:"If it was so progressive, why did he oppose other governments doing it? Obviously, it's against the poor and middle class." (sic)

Currently, on average, a gallon of gasoline sells for $15.868 and a gallon of diesel for $10.685.

Article 6 of the tax reform provides for the addition of a paragraph to article 468 of the Tax Statute, which will read as follows:

The following liquid fuels derived from petroleum will have the following sales tax rate, VAT:

- By 2026, the producer's income tax on gasoline sales will be 10%. As of January 1, 2027, it will be taxed at the general rate.

- For the years 2026 and 2027, the producer's income rate on the sale of ACPM will be 10% and as of January 1, 2028, the general rate will apply.

- As of January 1, 2027, biofuel of plant or animal origin for use in domestically produced diesel engines intended for mixing with ACPM will be taxed at the general rate.

- As of July 1, 2026, fuel alcohol intended for mixing with gasoline for motor vehicles will be taxed at the general rate.

- For all other petroleum-derived fuels and those responsible for these goods, the general rate will apply as of January 1, 2026.